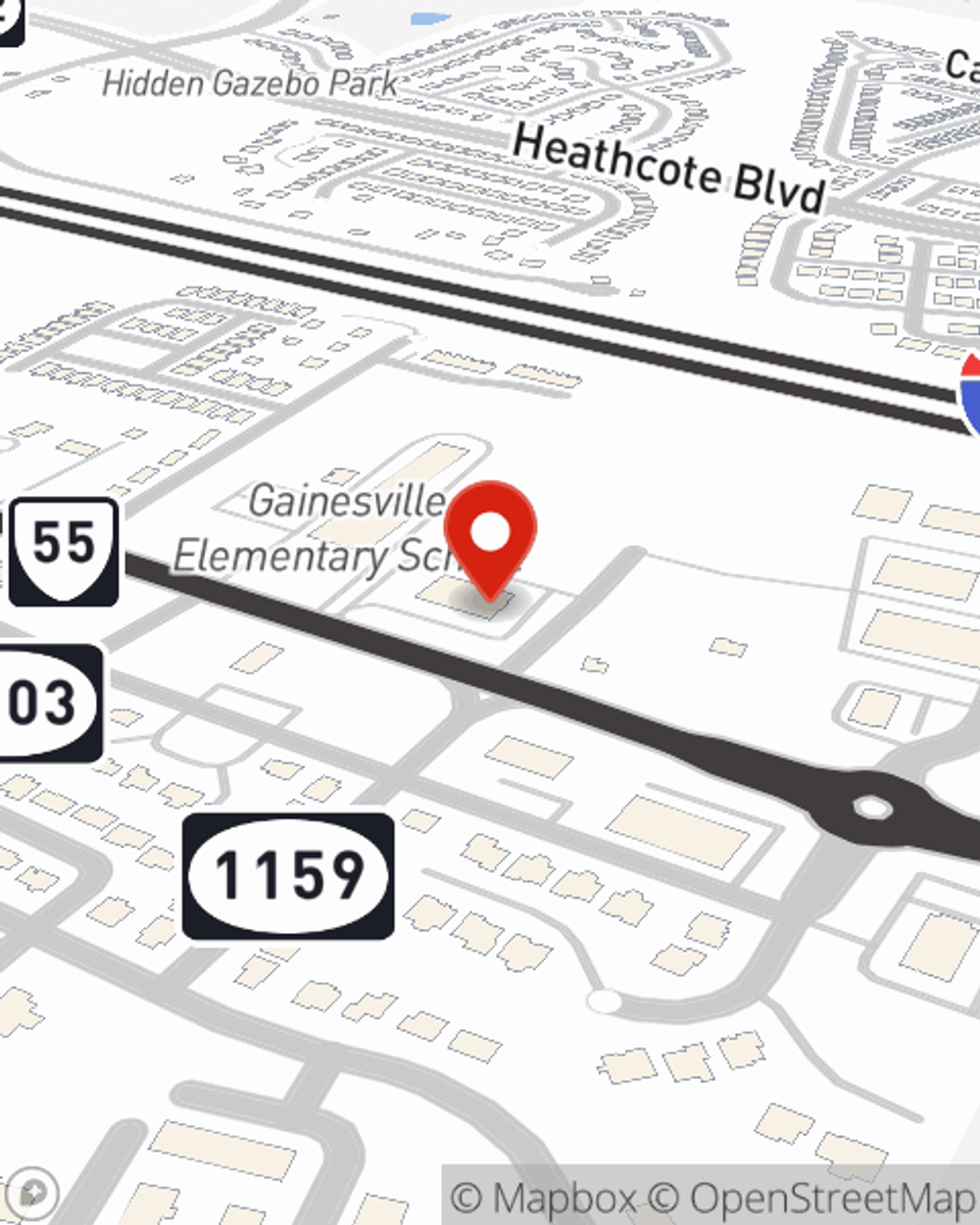

Life Insurance in and around Gainesville

Get insured for what matters to you

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- DC Metro Area

- Prince William Co

- Town of Haymarket

- New Baltimore

- Gainesville

- Town of Warrenton

- Bristow

- Nokesville

- Virginia

- Maryland

- North Carolina

Be There For Your Loved Ones

State Farm understands your desire to care for the people you're closest to after you pass away. That's why we offer excellent Life insurance coverage options and reliable empathetic service to help you opt for a policy that fits your needs.

Get insured for what matters to you

Don't delay your search for Life insurance

Life Insurance Options To Fit Your Needs

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you decide on can be designed to fit your current and future needs. Then you can consider the cost of a policy, which is calculated using how old you are and your health status. Other factors that may be considered include lifestyle and body weight. State Farm Agent Anita Sadlack can walk you through all these options and can help you determine how much coverage you need.

To experience how State Farm can help protect your loved ones, contact Anita Sadlack's office today!

Have More Questions About Life Insurance?

Call Anita at (571) 445-3487 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Anita Sadlack

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.